While city centres are approaching pre-pandemic levels, the North West remains 4.1% up on 2020, but still lower as compared to the national average than it was the previous year, meaning that Wirral renters are still getting a great deal on rental properties compared to their city and southern England counterparts.

What the report says

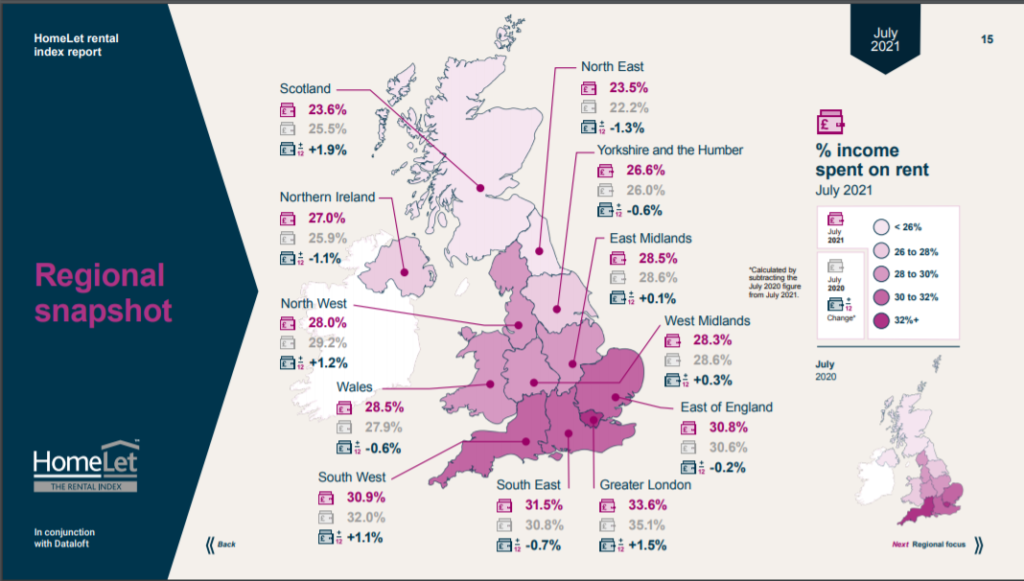

The report provides further evidence of a real north-south divide in the rental market, with UK averages skewed by rental values in the south east. However, it also demonstrates that there is a consistent trend throughout the UK for rent to equate to between 25% and 30% in England and Wales (dropping to below 25% in Scotland and hitting 35%+ in Greater London).

It is interesting to note that the North West, which has seen considerable growth throughout the last two years, has actually seen rent fall as a percentage of income.

The preface of the report raises an important consideration here, however, in that the end of furlough and growing rental arrears could result in job losses and real issues in many regions of England. With Scotland and Wales both having rent relief measures in place, it may be left to tenants and landlords in England to bear the brunt of the economic pressures resulting from the pandemic.

It remains to be seen whether the Number 10 will follow the lead of the devolved governments, but a failure to do so could lead to a crisis in some areas of England.

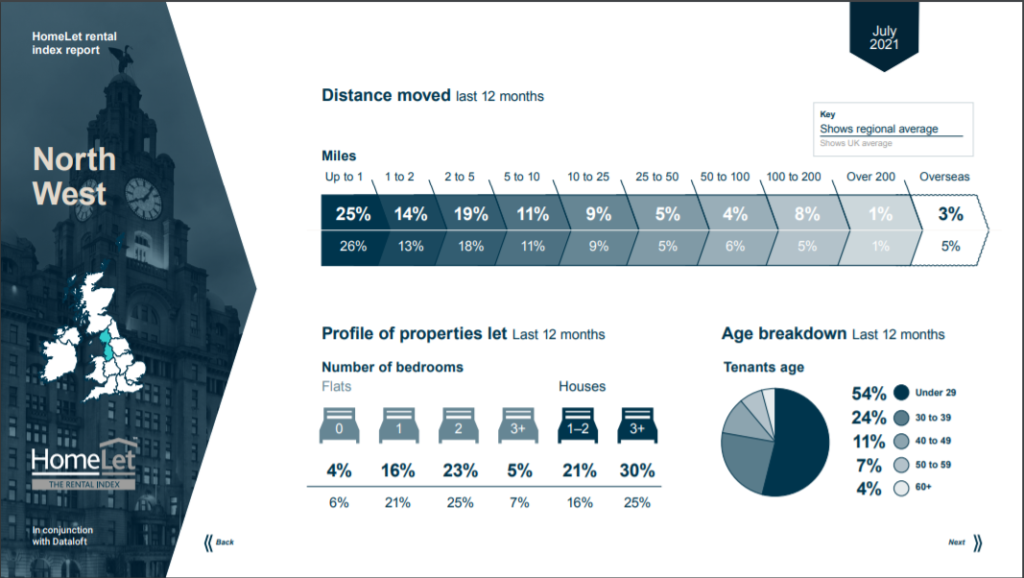

The report also offers a regional breakdown for the North West which offers the following insight into the average renter in the region:

- Average age: – while no doubt skewed by the region’s wealth of universities, the average age of renter in the North West, according to HomeLet data, is between 20 and 29.

- Median income: – excluding those incomes likely to skew the data (below £10k and above £500k) the median income of tenants in the region is £23,782 versus the national median of £27,666.

- Predominant rental band: – the rental stock in the region, in line with the national average, falls in a band between £500 and £750 per month.

- Average percent of tenant income spent on rent: – while rents have increased in some areas, and decreased in others, the average percentage of wages spent has dropped slightly and now comes in at 28% of income – almost 2% lower than the national average.

There is also a rundown of the properties let in the last 12 months. This showed that the most popular flats (at 23% of total) are those with 2 bedrooms, while the most popular houses are those with 3 or more.

What this means for Wirral landlords

Though it’s difficult to apply the findings of a region to a constituent part – skewed as the data would be by the larger cities and towns of the region, it is possible to state with reasonable certainty that, though the rent tends to be slightly above the regional average, the median wage has historically been higher and, therefore, the percentage of tenant income spent on rent should be around the same as the region as a whole.

In turn, this suggests that rental yields in the region, which are already above average for the UK as a whole, remain viable for the foreseeable future – with buy-to-let mortgages covered well enough to provide an income above and beyond the necessary buffer required for expenses and regular outgoings. As such, the report seems to reinforce our generally held belief that Wirral properties are likely to remain an excellent option for investment.

What this means for Wirral tenants

The main takeaway for Wirral’s renters is that the real-terms cost of renting in the region and, likely, the Wirral too, has fallen over the last 12 months versus the average wages in the area. Added to the increased ability for some workers to do so from home, this makes the area a fantastic place for tenants to live while saving to take their first step onto the property ladder.

We subscribe to all of the latest reports to ensure that we’re in possession of the latest facts and figures, and able to help our landlords and tenants make the right decisions for them. Want some help with your portfolio, or your next move? Contact Us today.