The latest House Price Index Report from Zoopla looks at the state of the property market up to the end of April 2021 and carries a wide variety of information that should be of interest to tenants and landlords alike.

What the report says

While uncertainty has been the watchword of the last few years economically, as we’ve discussed in previous articles – the property market has had some extraordinary circumstances provoke some unpredictable changes. With changes to what buyers have been looking for, to the way we view property and expect it to offer, buyers and renters have been moving, not just to increase the number of rooms as they start their families, or decrease them as that family grows up, but because property has taken on new meaning through the course of 2021 – and that is reflected in £461 Bn in property sales.

Head of research at Zoopla, Gráinne Gilmore, said:

Buyer demand looks set to ease as the economy opens up but it will remain elevated compared to previous years, which we anticipate will create one of the busiest sales markets in more than a decade in 2021.

The report’s executive summary lays out the following key talking points:

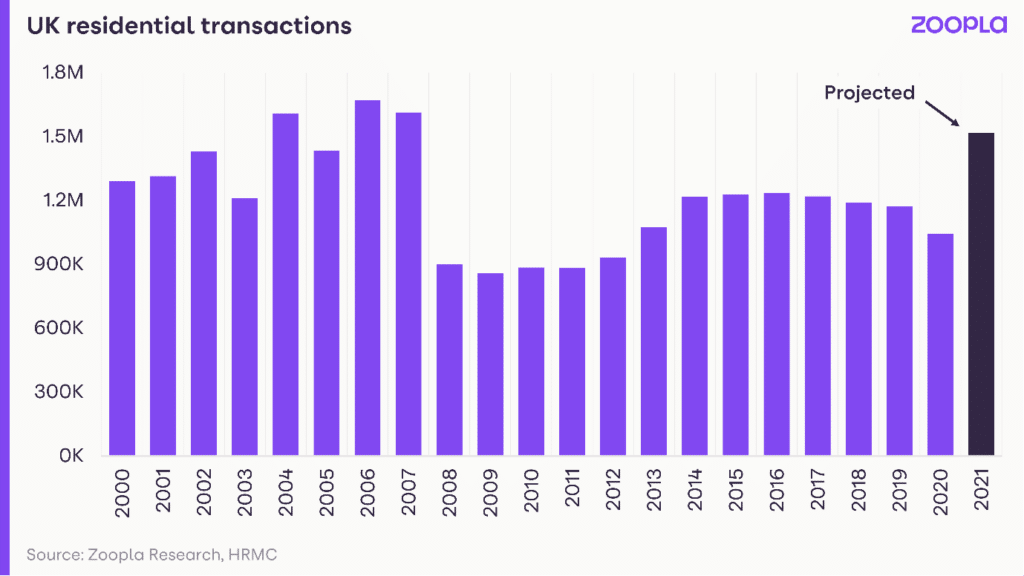

- Sales completions forecast to reach 1.5 million this year, up from 1.04 million last year and the highest level since 2007

- The value of sales in 2021 is forecast to be £461 billion, up 68% from 2019 amid a rise in higher value homes exchanging

- Total stock of homes for sale remains constrained, down 20.8% in the year to mid-May compared to the average last year

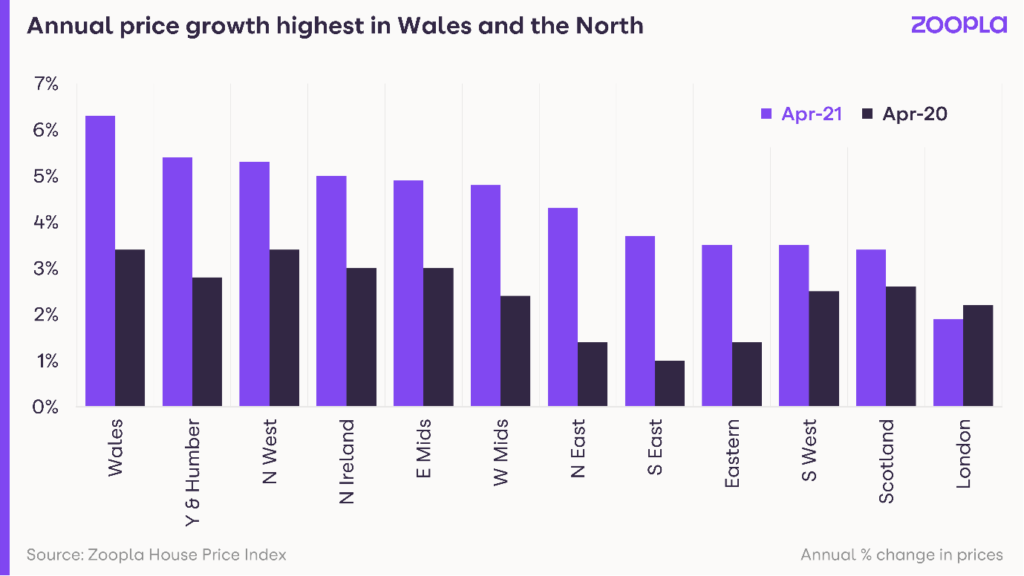

- Annual house price growth is at 4.1%, up from 2.3% a year ago

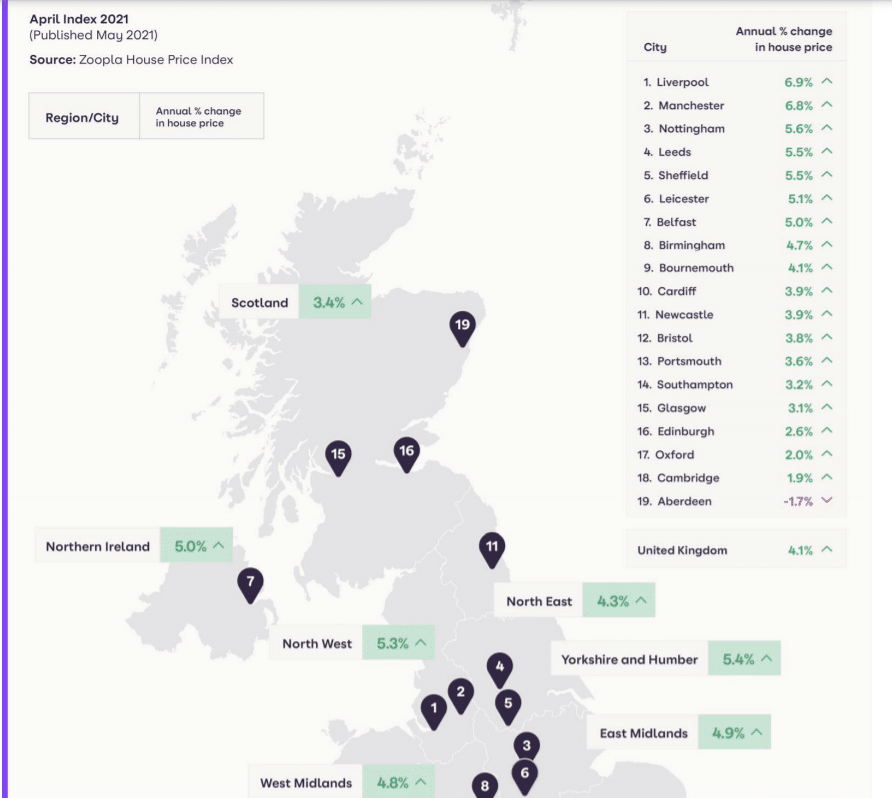

- On a regional basis, the largest price growth is in Wales, at 6.3% and Yorkshire & the Humber at 5.4%

- Price growth in London is at 1.9%, the lowest level since March last year

While general CPI inflation remains at around 1%, house price inflation is at around 4% YoY – though this is just shy of 5% in the North West, just over 6% in Wales and in the Liverpool city region the increase is almost 7% (the highest of any UK city). This means that property value is rising at a rate much faster than general levels of inflation, making property more valuable in real terms.

What this report means for Wirral landlords

We’ve stated in previous articles that there are a number of ways landlords tend to treat real-terms (above inflation) property price increases – there are those that will look to exit the letting industry and cash in on one or more properties (this tends to be only popular among landlords owning one or two properties), there are those that will sell one or more properties and reinvest the profits into expanding, diversifying or improving their portfolio, and there are those that will look to reorganise their lending to free up capital to invest in their portfolio.

In truth, any of these options are perfectly rational for Wirral landlords – though it depends on how you see the future of the local market. At Wirral Homes, we believe that the number of projects currently in progress and the increasing investment in the area (as decentralisation of business, and remote working become an expectation rather than an option in some sectors) mean that property prices in the region are likely to remain on an upward trajectory in excess of the national average for at least the mid-term, making investment the recommended advice for our landlords.

What this report means for Wirral tenants

Affordability of rent is an issue throughout the UK and while the North West has some of the lowest rental costs as a percentage of income, there is still hope to be found for renters in the region in the projected flattening of rental prices which will come as a result of increased demand for city centre property. As we reach (hopefully) the end of lockdown measures, demand for city centre property has seen an increase – this will reduce upward pressure on rents in the more rural Wirral region, and therefore a stabilising of rent as demand and supply begin to reach more manageable levels.

Whether you’re new to the property sector or an old hand, it can be difficult to keep up to date with the constantly changing sector – but if you’d like a little help staying on top of things and reducing the stress of managing a property portfolio, you can Contact Us to see what we can do for you.