Zoopla’s Q3 report, unlike a lot of the last year’s news, makes for pretty pleasant reading for landlords who should be buoyed by inner city demand returning to normal as well as steadily rising demand and rental returns.

What the report says

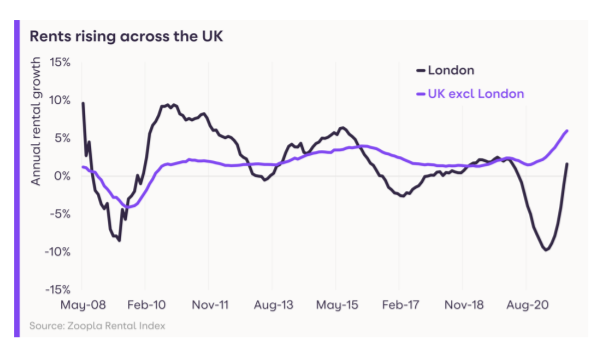

With rental stock failing to meet demand by a large and growing amount, the report finds that the consequent increase in demand for those remaining properties has reduced the time it takes to re-let a property to 15% and has caused rental prices to increase above inflation for the second consecutive year.

The structural undersupply of rental property across the UK, amid higher levels of demand, will underpin rental growth in 2022.

Gráinne Gilmore – Head of Research, Zoopla

In fact, the Q3 rental growth for 2021 has hit the highest levels since the 2008 global financial crisis – and demand has doubled in major city centres following a significant drop during the height of the pandemic, having just about overtaken pre-Covid levels, though the availability of property is 43% below the five-year average.

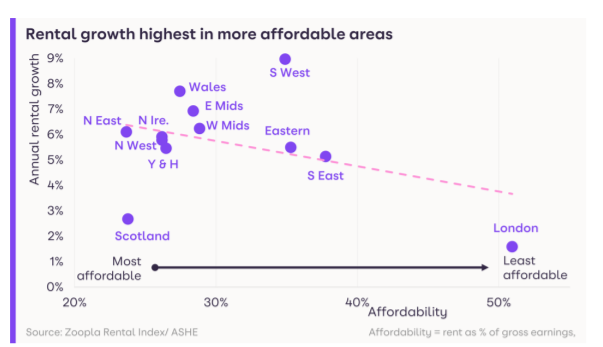

The report, however, does point out that despite the increase in rents, the affordability of rents has remained in line with the five-year average of 37% of income – and this, depending on the outcome of what has been termed ‘the great resignation’, may see these increased rents actually buck trends in 2022 if employees are able to maintain the influence gained by staffing shortfalls to increase the median wages.

While inflation is often seen as a negative for the economy, for net debtors – which includes the majority of landlords and tenants – above average inflation, especially if balanced by rising wages, sees the value of debt fall and the real-terms income rise, allowing for a later rebalancing of the economy and, barring government action, a greater level of affordability for tenants.

Six stats from the report

- +6.0% – annual change in rents, UK (excluding London)

- +1.6% – annual change in rents (in London)

- +4.6% – annual change in rents (UK average)

- 37% – affordability: % of salary to cover rent (single earner, UK)

- 15days – average time to let a property (UK average)

- £968 – monthly rent (UK average)

What this means for Wirral landlords

If the overall tone of the report is positive, the news for Wirral landlords is among the most positive. While rental demand has increased overall, the North West has seen above average growth in demand and rental prices.

This is driven, at least in part, by the changing way that certain sectors work, allowing workforces to relocate to more affordable areas of the UK. While many of the sectors that have moved to remote work will have an above average level of home-ownership, many of the properties they will have bought will have been those sold by landlords looking to cash in on rising house prices to upgrade remaining properties, or by those exiting the rental sector.

As such, there is ample reason for Wirral landlords to look at expanding their property portfolio – inflation is likely to reduce the debt-load in excess of increased price of purchase for most landlords with a portfolio, while reduced times to re-let will see a reduction in costly vacant periods. In fact, Wirral landlords are among the best placed to reap the benefits of increasing their investment – whether that’s through capital injection or through restructuring.

While the news has been mixed over the last couple of years – HMRC has repeatedly dropped the ball, the pressure to increase energy efficiency has not been ameliorated by substandard government schemes, and landlords have – like everyone else – felt the financial and emotional burden of a pandemic, but while the news is mixed, the present moment offers a real chance to exit a period of unique turbulence in a manner that will leave the last two years somehow having delivered net positive results.

If you’d like some help to take the pain out of portfolio management, or advice on how best to take advantage of an excellent time to invest in Wirral property, Contact Us and speak to one of our experts to see how we can help you make the most of your investment.