We’ve mentioned in previous pieces that the economic outlook becomes increasingly uncertain toward the end of 2021 and in to 2022 and Nationwide are similarly cautious despite some of the headlines their commentary has provoked.

What Nationwide had to say

While many of the headlines based on the announcement from Nationwide that there were ‘fears of a negative equity crisis if…’ the announcement made was reasonably unsensational and set out a number of required criteria for that to happen – including a worst-case-scenario number of lay-offs once the governmental assistance some businesses have been receiving ends.

While there may be a larger than average number of buyers left with negative equity should house-prices collapse post-pandemic and stamp-duty holiday, which would see a surfeit of property hit the market and a drop in the number of buyers, it is unlikely to cause the problems that led to a multi-year stagnation post-financial crisis.

In fact, Nationwide has been one of the few lenders providing 90% mortgages for almost the entirety of the stamp duty holiday – and have not yet, at the time of writing, withdrawn the products. As such, we’d be willing to bet that the worst-case-scenario is not the expected outcome for their underwriters.

Do Wirral buyers and landlords need to worry?

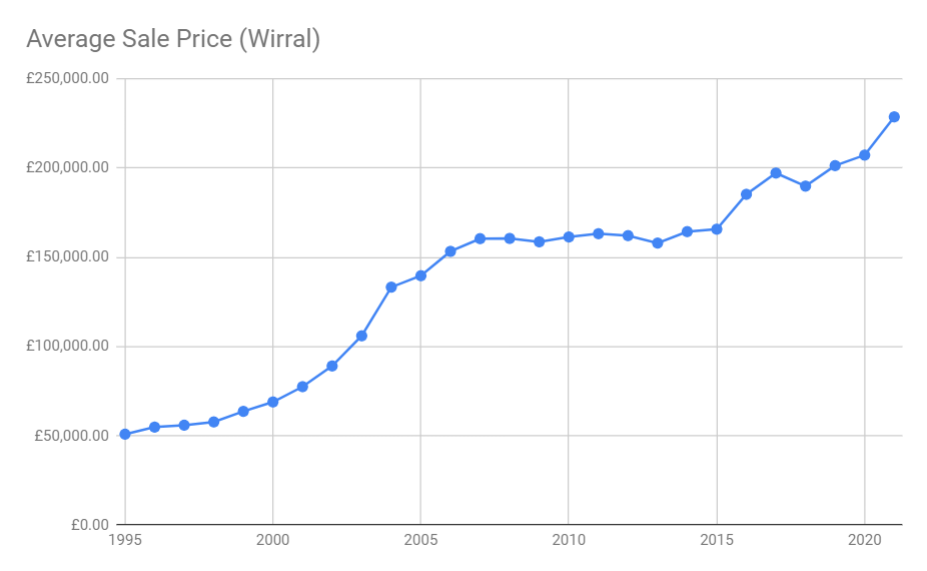

While the increase in Wirral property prices has been substantial over the last 12-18 months, the rise is neither unprecedented over the last decade, nor in excess of what the market is capable of sustaining. Even the final uplift in property prices on the peninsula has only brought the average property price in-line with the national average of £250,000.

In fact, since the recovery from the 2008 financial crisis began around 2010, there have only been 3 years where the average Wirral property price has dropped (2012, 2013 and 2018) and those losses have been quickly recouped and exceeded in the year or two that followed. Indeed, the rise between 2015 and 2016 was actually greater as a percentage of total value than the increase between 2020 and 2021.

While there are, of course, reasons to be cautious as we approach the end of various packages of assistance that have helped to keep the property market growing over the last two years, Wirral is likely to be insulated from many of the main problems – with a generally wealthier population, homeowners on the peninsula are more likely to have worked from home during the pandemic and within industries which are likely to have been less harshly impacted by and more likely to recover from the pandemic.

For that reason, and with property demand still massively outstripping availability, there are unlikely to be a glut of unsold and unsellable properties hitting the market that could cause the drops likely to initiate the ‘crisis of negative equity’ that could occur elsewhere. In truth, it’s difficult to be certain how the end of the pandemic will impact buyer behaviour, its unprecedented nature makes the gloomy headlines less certain than many would have you believe.

What lies ahead for Wirral property prices?

Wirral will remain a fantastic place to invest over the coming year. With property prices hitting the national average, there is still room for growth in what has become a hugely popular area for buyers moving out of cities, for families and retirees. The factors that have made the peninsula hugely popular throughout the pandemic will not change regardless of governmental assistance – it is well connected, vibrant and developing, with hugely ambitious projects set to come to fruition in the next 5-10 years.

Though we would predict a lower rate of property value growth over the next year, growth should still be expected – and it’s still likely to exceed the national average (as it has done throughout the pandemic). While a higher-than-average growth may not see high single- or double-digit increases, owning a Wirral property will remain an excellent investment for all types of buyers – but especially for landlords with a long-term view of their portfolio.

Worried about your investment, or looking to discuss investing in the Wirral property market? Contact Us today to talk to one of our experts and see what we can do to help you grow your business.