While consistent upward pressure on house-prices will have negative effects on first-time buyers, it may provide welcome relief for landlords looking for ways to fund renovations and upgrades required to meet new energy efficiency standards.

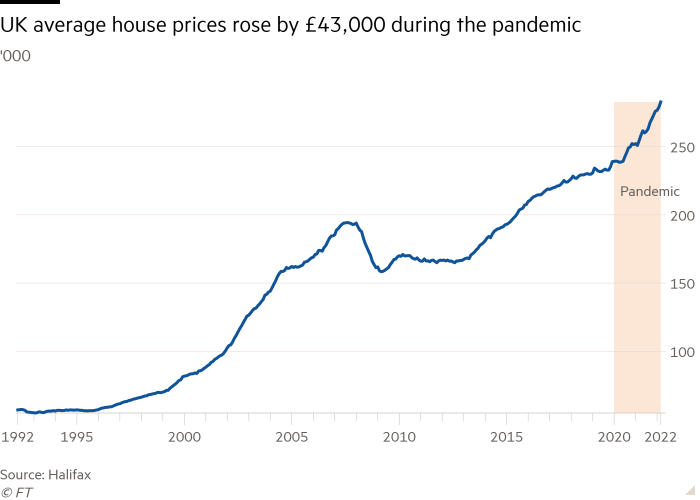

Regular readers of the stories we read here will be familiar with the huge rise in Wirral property prices that was supercharged by the pandemic, and our commentary that this would likely continue to at least the middle of the year. While things are in constant flux from a macro-economic and political level, it seems that upward pressures have, so far, been sufficient to overcome several opposing forces (such as the reduction of buying power caused by recent excessive energy bill increases and poor wage growth).

Quoted in the Financial Times, Chief Executive of mortgage broker SPF Private Clients, Mark Harris, said that “lenders are still keen to lend and have plenty of cash available to do so, enabling borrowers who are maybe sitting on considerable savings accrued during lockdown to stretch themselves to afford a bigger property”. This is only part of the story, however, as buyers are not the only factor to consider – as the Managing Director of Halifax, Russell Galley, stated:

With 2021’s strong momentum continuing into the beginning of this year, the annual rate of house price inflation (11.0 per cent) continues to track around its highest level since mid-2007. The new record price of £282,753 is up some £28,113 on a year ago, not far off average UK earnings over the same period (£28,860).

The story behind such strong house price inflation remains unchanged: limited supply and strong demand, despite the prospect of increasing pressure on households’ finances. Although there is some recent evidence of more homes coming onto the market, the fundamental issue remains that too many buyers are chasing too few properties.

The effect on house prices makes it increasingly difficult for first-time buyers looking to make their first step onto the ladder, but also challenges homemovers who face ever bigger leaps to move up the rungs to a larger property.

As we’ve made mention previously, however, such price increases are unlikely to continue at such a pace for the rest of the year and, as various economic and global issues begin to bite, the anti-inflationary forces are likely to see house prices stabilise in the second half of 2022. On this subject, Galley had this to say:

[In] the long-term we know the performance of the housing market remains inextricably linked to the health of the wider economy. There is no doubt that households face a significant squeeze on real earnings, and the difficulty for policy-makers in needing to support the economy yet contain inflation is now even more acute because of the impact of the war in Ukraine.

Buyers are therefore dealing with the prospect of higher interest rates and a higher cost of living. With affordability metrics already extremely stretched, these factors should lead to a slowdown in house price inflation over the next year.

What this means for Wirral landlords

As stated, in the short term this can offer landlords some short-term relief – the region has seen above average increases in property prices and that increase in capital value, if leveraged correctly, could help to offset the potentially costly improvements to rental properties required to meet changing EPC requirements.

With interest rates still extremely low considering inflationary pressures, landlords considering using capital increase to make improvements should do so fairly quickly, however. Long periods of inflation will tend to lead to higher interest rates and while things are unlikely to reach the levels of the 80s and 90s, the moment is right for landlords to make the most of low interest rates and high levels of capital value growth to make improvements that will benefit both their portfolio and their tenants in the long-term.

In addition, with Wirral properties still generally priced below the UK average, there is also a strong argument for investors from outside the region to add Wirral properties to their portfolio.

We’re at a moment when current affairs are tough enough to keep up to date with, without the additional need to follow the fast-moving world of the property market. Considering seeking some help making the most of your property portfolio? Contact Us to see what our experts can do for you.