Although we don’t see huge departure from the trends we’ve mentioned in recent articles, there is much to be said for keeping on top of the latest insights from companies like HomeLet, which can help landlords to know which way the wind is blowing within the sector as a whole.

What the report says

Essentially the report outlines many of the trends we’ve covered here over the last year – including in write-ups of Zoopla and HomeLet quarterly reports. There is a tracking of the increase in rental prices and discussion of the various factors driving those rises – the work from home revolution increasing demand in more rural areas, for example, and the quest for space, to name just a couple.

While the majority of the report is pretty London-centric, there are some interesting sections breaking down 2021 by region which will provide some food for thought for landlords outside of the capital – especially for those looking to examine the rental value of their portfolio.

One interesting comment, which comes at the front of the report, however, is from Andy Halstead, Group CEO of HomeLet and Let Alliance, who is quoted as saying:

We expect to see some increased variation in rental prices in December compared to 2020. The lockdowns and restrictions impacted demand in many areas. A positive aspect is that we’re seeing demand in urban areas increase after the shift last year to property in commutable locations, outside towns and cities.

This seems to be the crux of the report which, while it does touch on other issues, is understandably focused on the economic outlook for landlords. There is, however, already substantial variability in rental prices across the UK, and predicting an increase in this gives us little to get our teeth into. As such, looking at the data in the report, we’re comfortable to stick with our prediction for the region – that rental prices are likely to rise both in response to demand and inflation – though perhaps not as much as we’ve seen in the last couple of years.

What this means for Wirral landlords

While the private rental sector in the UK has undoubtedly become more profitable at the most basic level (yields and property value are rising while there have been no major tax reforms that would undermine that growth), the HomeLet report points out something else we’ve mentioned here before, stating:

The UK relies heavily on the private rental sector and needs landlords. As the level of change and legislation increases, it’s becoming essential for many landlords to use the management services of professional letting agents. Government policy must consider the impact of legislation on landlords and the unintended consequences these changes can have.

It is the amount of work that is currently causing headaches in a sector where, typically, many participants have a main occupation and let property as a secondary investment for the future. Such changes are going to make it increasingly difficult for landlords to find the time to keep up to date with legislation, not to mention implement necessary changes.

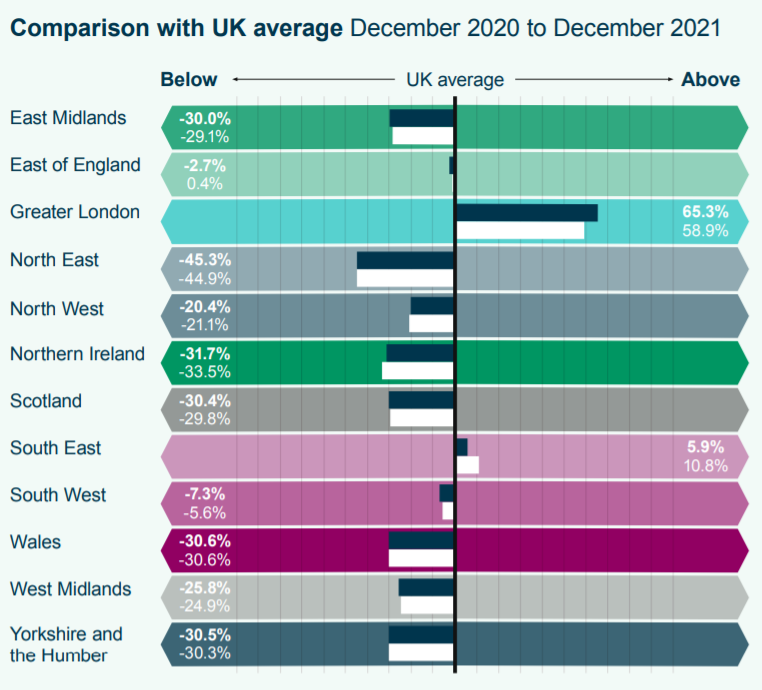

There is some good news for landlords, however, as the report also shows that despite increases in rental prices, the market has maintained rental prices at around the same level – some 20% below the national average.

With the North West therefore currently statistically one of the cheaper places to rent a property, there is an argument to be made that those landlords with contracts about to end, or who are just entering the private rental sector, will need to evaluate the market potential of their property.

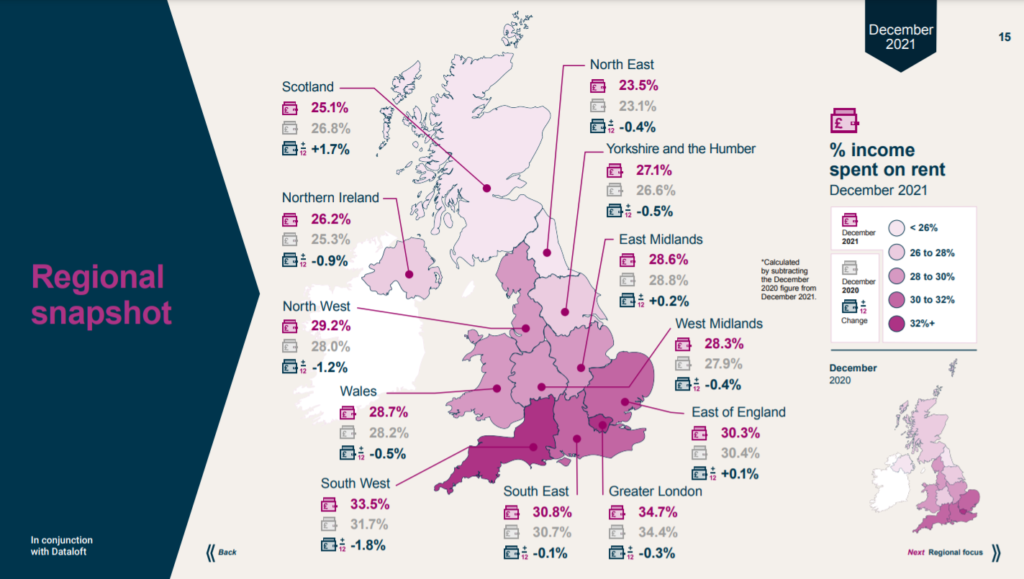

The average tenant will presently spend around 30% of income on rent – and while the North West is around the middle of the pack where affordability is concerned, there will need to be close examination of rental prices as 2022 promises to be an expensive year due to incoming legislation on energy efficiency, and smoke and carbon monoxide alarms.

Need some help to take the stress out of managing your property portfolio? Why not Contact Us to see what we can do for you.