With house prices climbing in excess of the already steep 4.2% of 2020 and available housing stock down by 15% year on year, the message sent by the latest report is that the current growth in house prices is not quite over.

What the report says

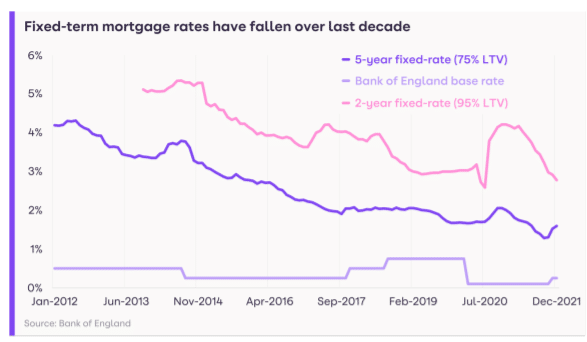

The overall report paints a relatively optimistic portrait of the current market conditions in the UK as a whole. Despite the number of houses available for sale being 44% lower than the five-year average, this imbalance is slowly reversing, and the total supply is building gradually since the turn of the year. In addition, while inflation may be dominating the news cycle, the report reminds us that, even with interest rate rises of a few quarter points from the Bank of England, mortgage rates are still unlikely to reach the levels of 2012.

In addition to this, Gráinne Gilmore, Head of Research for Zoopla also points out that house prices are still being pushed up by issues peculiar to the pandemic:

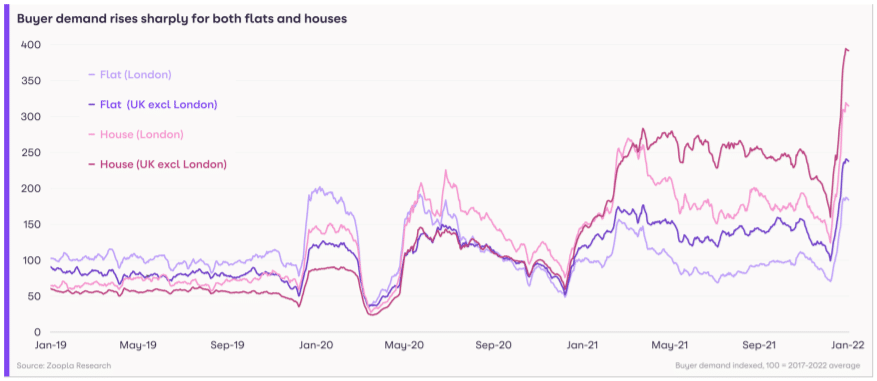

The pandemic ‘search for space’ continues, pushing demand for houses to record highs. Demand is also rising sharply for flats, with international demand, relative affordability and workers flowing back into cities all combining to energise this market.

Overall, the report states, house prices have grown by 7.4% on average, hitting £242,000 (a rise of around £17,000 during 2021) with Wales and the North West leading the way in terms of percentage growth (although still below the national average for overall average price). The demand is not just for family homes, however, having grown across the board:

The overall message of the report, therefore, is one of cautious optimism – the significant imbalance between the demand and supply of homes for is likely to continue to apply upward pressure on prices, which will offset some of effects of the likely economic turbulence ahead in 2022. Zoopla expects the average home value to rise by around 3% over the course of the year, which will range from 2% in London to around 4% in the North West and East Midlands. They also forecast around 1.2 million transactions, which, though a 300,000 drop from last year’s total, will keep it in line with the five-year average.

What this means for Wirral landlords

While, like all UK residents, landlords will likely face their fair share of financial issues in 2022 due to an end to Universal Credit uplifts, government inaction over COVID arrears and various regulatory changes, the rising house prices in the region position Wirral landlords better than most to face the year ahead.

With the right approach, landlords may be able to pay for energy efficiency improvements by restructuring their debt and releasing some of the value from their portfolio to upgrade their properties in the knowledge that their properties are likely to increase in value enough during the year to offset their outlay.

In addition to this, the market suggests that there is still room to improve the yield on many Wirral properties – which are still let at prices not just below the UK average rental price, but also below the average affordability level. This means that landlords with contracts coming to an end could see both the prices of their properties increase throughout 2022, but also the average yield of their properties – even if they need to invest in improvement work.

If you’re dreading the work involved in meeting various legislative changes, or aren’t sure where to start to make the most of positive changes in the market, why not Contact Us to see if our experts can take a little bit of the stress out of managing your portfolio?