Research by mortgage provider Paragon and BVA BDRC indicates that a larger proportion of landlords are looking to expand their property portfolio than at the same point last year, but with Wirral property commanding significantly higher prices than versus the same period, it’s understandable that there are some landlords considering letting one or more properties go.

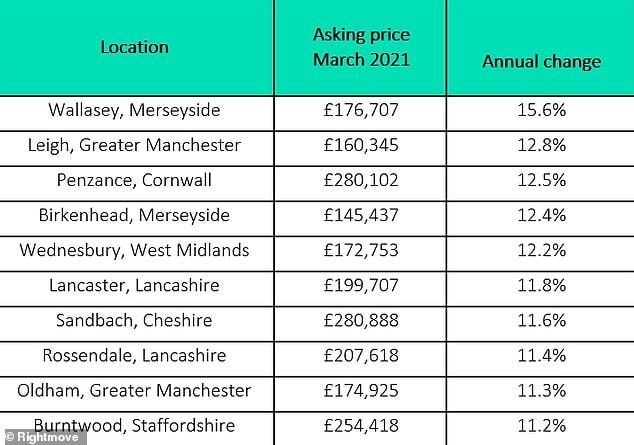

With two of the North West’s largest increases year-on-year (according to Rightmove), it would be surprising if some Wirral landlords weren’t looking to sell one or two properties to invest the funds in the rest of their portfolio but, with yields high, the property market represents an interesting dilemma for landlords.

What does the Paragon and BVA BDRC research say?

The raw data doesn’t seem to be available anywhere, but the press release states that ‘almost 900’ landlords were surveyed, with 19% of all respondents stating an intention to invest – of which landlords with larger property portfolios more likely to add to their portfolio (around 30% of landlords with more than 10 properties).

Richard Rowntree, Managing Director for Mortgages at Paragon, stated:

News that for the first time in over four years more landlords are intending on buying than selling is fantastic. This is because not only is it good for the industry but, more importantly, it’s good for tenants. More investment in the private rented sector contributes to higher standards, a moderation of rents and more choice for the millions who rely on the private rented sector for flexible, affordable housing.

During the uncertainty of the past year or so, the role of the PRS has become increasingly important, evidenced by the extremely high levels of demand we have seen for some time now, it’s great to see landlords are responding to this.

The press release also states that less than a fifth of the landlords surveyed have expressed an intention to sell.

With a good representative sample size, but no information on how the sampling was performed across the various regions of the UK, we can’t really determine for definite how accurate the survey is – but it’s certainly better than many. As such, we think it represents a pretty good indication of the general feeling in the industry.

What does this mean for Wirral landlords?

Wirral landlords – like those in many of the rural and suburban areas of the UK – have experienced the last year somewhat differently to those in urban and city centre areas. As mentioned, the value of property has increased substantially more than in many other areas of the UK, and yields are higher than average and improving, so it’s no wonder some landlords may be in a quandary.

In our opinion, investment in Wirral is a hugely attractive prospect at the moment, and we would advise landlords managing a property portfolio to take this into account when calculating their prospects. The improved value may open up options for refinancing – releasing equity from the increased value of the portfolio in order to expand it. While the same increase in value will have obviously impacted purchase as well as sales prices, for landlords, there is a lot more room for manoeuvre in picking up a ‘fixer-upper’ if the portfolio will support such a property or properties while they are renovated.

There is a lot of regeneration work being planned in and around some of the historically lesser invested in areas of Wirral – and that could allow savvy investors to reap major rewards in the mid-term for those with a good knowledge of the area.

Want to discuss the possibilities on offer, or looking for a local expert to help you to manage and grow your Wirral property portfolio? Why not Contact Us today to see what we can do to help you get the most out of your portfolio?